Table of Contents

Directors | Management | Agenda | 84th Annual Membership Meeting Minutes | Treasurer’s Report | Statements of Financial Condition | Statements of Income | Statements of Members’ Equity | Election Rules

Directors

Samuel Shores, Chairman (2025)

Mark Kulwicki, Vice-Chairman (2024)

Roman Almaguer, Secretary/Treasurer (2024)

Sabra Morlan (2025)

Manuel Esquivel III (2026)

Luther Hight (2024)

Curtis Reeves (2026)

Management

Wanda Muessel, Chief Executive Officer

Paul Besse, Chief Financial Officer

Blake Kemmis, Chief Information Officer

Adriana Crisp, Chief Operations Officer

Belinda Reeves, Member Service Manager

Eric Flores, Consumer Loan Manager

Debra Garza, Mortgage Loan Manager

Vanessa Vera, Collections Manager

Laura Chairez, Harlingen Branch Manager

Kimberly Villafuerte, Accounting Manager

Agenda

- Welcome – Samuel Shores, Chairman

- Invocation

- Determination of a Quorum

- Introduction of Directors

- Minutes of the Previous Meeting

- Election of Directors: Rules and Nominations

- Reports:

- Treasurer – Roman Almaguer

- Chairman – Samuel Shores

- CEO – Wanda Muessel

- Unfinished Business

- New Business

- Election of Directors: Results

- Adjournment

Minutes

84th Annual Membership Meeting

February 21, 2023

The 84th Annual Membership Meeting of Members First Credit Union was held on Tuesday, February 21, 2023, at the main office located at 5444 S. Staples, Corpus Christi, Texas.

Chairman of the Board Sam Shores welcomed members and brought the meeting to order at 6:00 p.m.

41 verified members registered for the meeting. The Chairman certified that a quorum was present and declared it a legal meeting.

The Chairman introduced the Board of Directors: Sam Shores (Chairman), Mark Kulwicki (Vice-Chairman), Roman Almaguer (Secretary/Treasurer), Manuel Esquivel III, Sabra Morlan, Luther Hight, and Curtis Reeves.

The Chairman stated the board met for 12 regular monthly meetings in 2022 and 8 special meetings.

Secretary/Treasurer Roman Almaguer noted a copy of the minutes of the 83rd Annual Meeting was provided in the Annual Report and asked for a motion to dispense with the reading and accepted them as written.

MOTION by Rachael Storr, second by Blake Kemmis to accept the minutes as written. MOTION CARRIED.

Report of Treasurer

Roman Almaguer reported that the credit union met our financial objectives in 2022. We funded over $31M in loans, growing over 14.6%. Deposit growth was slow at 0.8%. Net income for the year was one of the highest ever achieved at $2,412,288. The net operating expense ratio was 1.15%, which was lower than our peers at 2.02% and the capital to asset ratio ended at 20.13%, one of the highest levels among credit unions. An audit was completed by Harold Antao and company, LLC, which showed no areas of concern. Members continued to increase their use of remote services even as we saw a further return to normal operations. Mr. Almaguer thanked the board and staff and the members for entrusting the credit union with their financial needs.

MOTION by Debbie Garza, second by Paul Besse, approving the Treasurer’s Report as written. MOTION CARRIED.

Report of Chairman of the Board

Sam Shores stated that the credit union’s success depends on the involvement of our members and employees. The credit union continued to perform quite well with 12, 365 members, a net worth ratio of 20.13 percent, well over the 7% considered well capitalized. Though the credit union added 3,514 new loans in 2022, our delinquency ratio was low at 0.33%. He stated that though technology and digitization is advancing rapidly, the credit union is committed to optimizing services for our members. He recognized the board and employees for their dedication and leadership and the members for their support and loyalty and indicated that we can face any challenges we may encounter in 2023.

Report of the CEO

Wanda Muessel commented that a credit union is unique because of its member-owners. Members have appreciated how the credit union has helped them through the pandemic, but the pandemic has also changed the way services are obtained. The credit union is committed to develop online banking tools that are user friendly, expand account options to go beyond the basics, streamline processes to reduce friction and “pain points” for members, enhance cybersecurity to safeguard assets, data and privacy, support advocacy and lobbying efforts in the credit union movement and being visible and involved in the local community. She concluded by thanking the board and employees for their input and involvement. She also thanked the members for choosing Members First as their financial partner.

Unfinished Business

None

New Business

None

Nominating Committee

The Chairman appointed Luther Hight, Sabra Morlan and Mark Kulwicki to the nominating committee in September of 2022. The committee was charged with nominating two or more candidates for two 3-year terms expiring in 2023 (according to Credit Union guidelines, each member must be willing to serve, have an appropriate credit history, donate time and effort for the Credit Union’s future, and be a member in good standing).

The Nominating committee reported they received two applicants that were approved for the two open positions on the Board. The nominees were:

Manuel Esquivel III (3-year term)

Curtis Reeves (3-year term)

MOTION by Blake Kemmis, second by Severa Stapurewicz to elect the nominees by acclamation. MOTION CARRIED.

Conclusion and Adjournment

Chairman Sam Shores concluded the business of the meeting.

MOTION by Manuel De Los Santos, second by Adriana Crisp to adjourn the meeting. MOTION CARRIED.

The meeting was adjourned at 6:19 p.m.

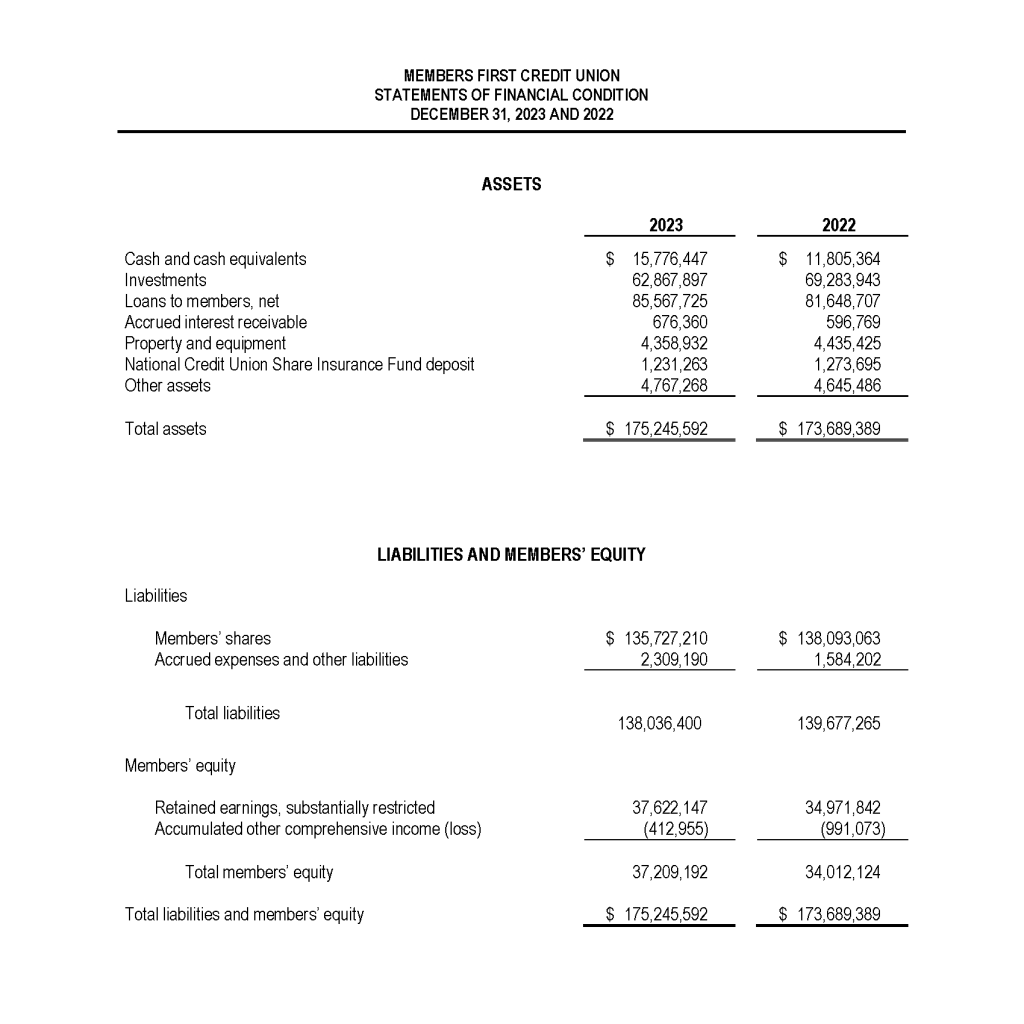

Treasurer’s Report

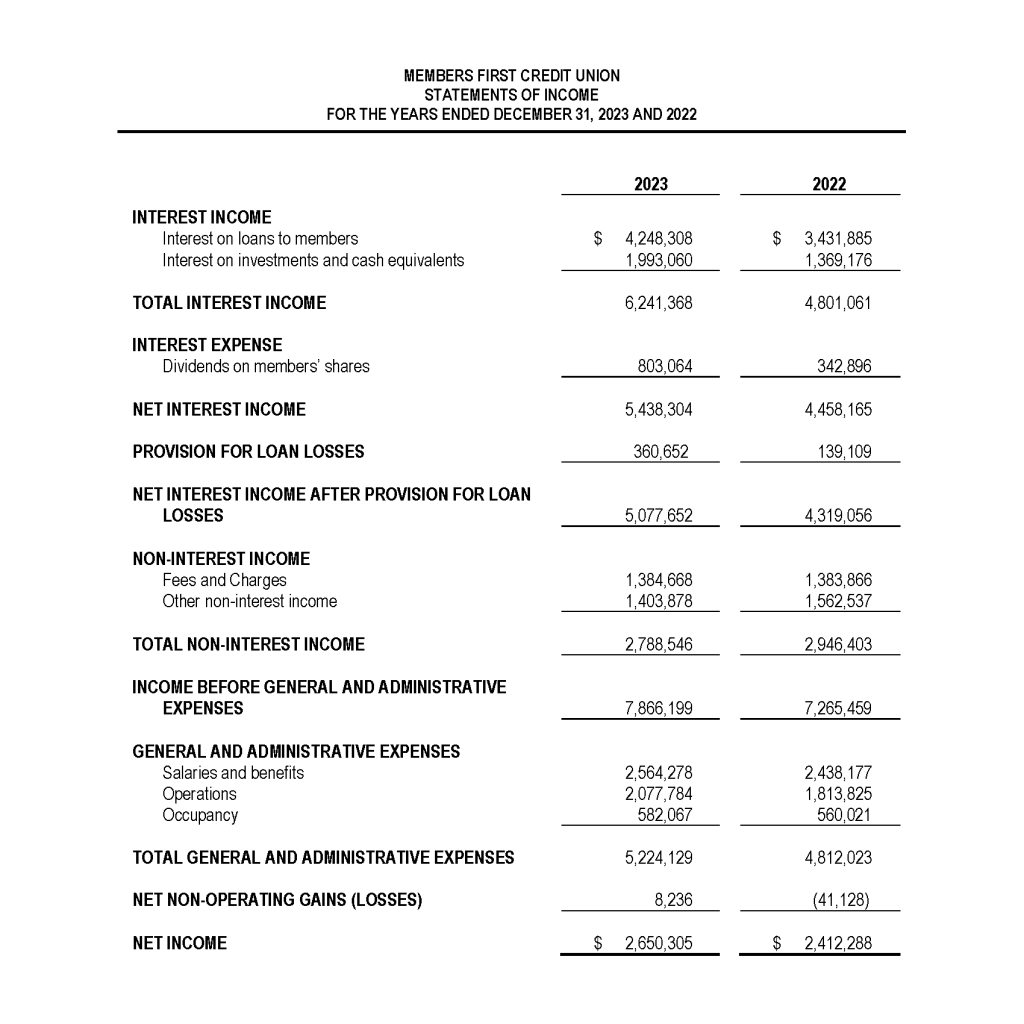

Members First Credit Union was very successful in meeting our financial objectives for 2023. Loans advanced during the year totaled $24,499,749. As a result, loans grew 14.8% for the year ending at $85,567,724. Growing our loan portfolio is always one of our main goals since it determines what deposit rates we can offer and is our main source of income but in 2023 loan growth had to be balanced with the increasing demand for deposits.

Member deposits declined this year as financial institutions competed for liquidity and consumer savings declined. Member deposits now total $135,727,210. Total assets increased to end the year at $175,245,592.

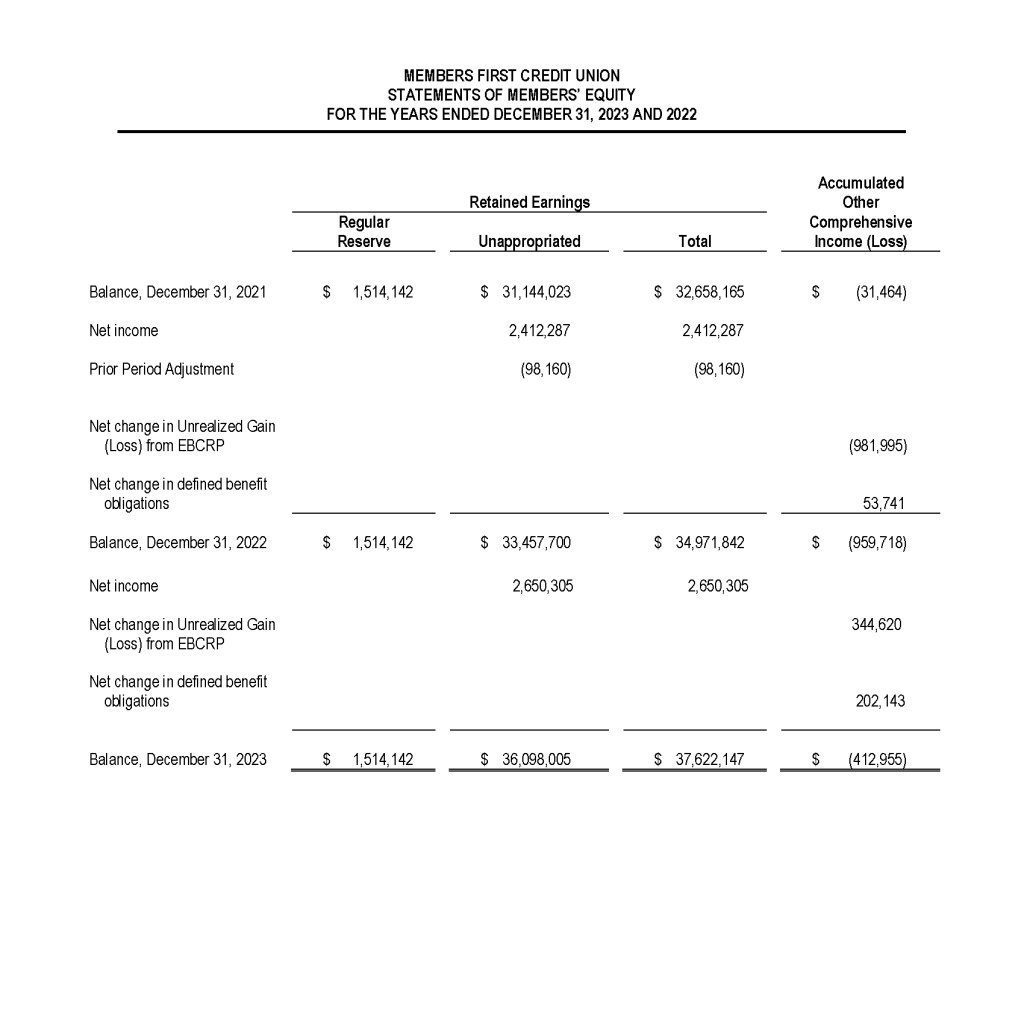

Members First continued to add capital in 2023 with net income for the year of $2,650,305. Our position continues to be positive with a capital to asset ratio of 21.47%. Income benefited from low loan losses, rising loan and investment rates and a low net operating expense ratio of 1.41% which is well below our peer ratio of 2.31%.

This past year, a Supervisory Committee Audit was held by Harold Antao and Company LLC to ensure our accounting practices and records are in order. Their report showed no concerns or exceptions.

2023 saw a further increase in usage of the many service options offered. These services include check cards (10,275), credit cards (2,424), CU Online (6,665), and mobile app (4,871).

I would like to acknowledge and thank the board and staff at Members First for their contributions to the success enjoyed by the credit union in 2023. We are also grateful to our members for their loyalty and dedication and for choosing Members First as your credit union.

Respectfully submitted,

Roman Almaguer Jr.

Secretary/Treasurer

Statements of Financial Condition

Statements of Income

Statements of Members’ Equity

Election Rules

(printed in the October 2023 newsletter)

Members interested in running for a position on the Board of Directors must submit a completed “Director Application and Agreement to Serve” form. A credit history of the applicant and current standing with the credit union will also be reviewed as part of the approval process. All interested parties that receive approval by the Nominating Committee based on these criteria will be included as candidates for upcoming vacancies on the Board of Directors.

Any applicant that the Nominating Committee does not approve will be referred for review by the Board of Directors. These members may be selected if approved by the Board. Any applicant not selected will receive a written explanation describing the reason for disapproval. This information will also be communicated to the Credit Union Department. Interested parties must submit their application no later than December 15, 2023. No nominations will be accepted after this deadline and no nominations may be placed from the floor at the Annual Meeting.

These rules were established so that all candidates or potential Directors would be in good standing with the Credit Union, would be insurable for bonding purposes, and would receive approval from the Credit Union Department.